This Isn’t a Game. It’s a System.

Most traders treat signals like lottery tickets.

They get the alert, jump in blind, panic at the first red candle, and wonder why it all falls apart.

That’s not trading. That’s reactive gambling with extra steps.

If you want to actually use crypto trading signals correctly — and not sabotage your own outcomes — you need to understand how we operate and why.

Because we’re not here to spoon-feed fantasies.

We’re here to give you the same raw signals we trade ourselves, with no edits, no emotion, and no bullshit.

The GLMUSDT Case Study — Real Trade, Real Lessons

Let’s walk through one of our actual signals from June 10th, 2025.

Asset: GLM/USDT

Direction: Short

Instant Entry: 0.2478

Stop Loss: 0.2538

Take Profit: 0.2349

Risk/Reward: 2.15

This was sent at 8:10 AM Los Angeles time.

Now here’s what happened:

Immediately after entry, the market didn’t drop. It climbed.

We watched price crawl closer to the stop loss, and frankly, that’s where most inexperienced traders start to freak out.

But we don’t flinch. Our system is built to take those hits. We don’t interfere. We don’t micro-manage the trades. We let the setup breathe — because the real edge comes from discipline, not tinkering.

Eventually, the market respected the setup, reversed, and cleanly hit the take profit.

And if you had exited early? You’d have missed the whole move.

That’s on you — not the market, not Trump, not Biden, not the whales.

How to Actually Use Our Crypto Signals (Without Screwing It Up)

We don’t run some “signals factory” to lure you into a VIP upsell.

There’s no premium version with better entries. Everyone gets the same thing — one signal, same entries, same exits.

But how you manage your own capital within that range? That’s the part most people get wrong.

So let’s make it useful.

1. You don’t have to enter at the exact signal price

The idea of entering the second a signal is posted is flawed. If the price moves toward the stop loss first, that’s not a failure — it’s an opportunity. You could get a better entry, tighter risk, and a stronger risk/reward setup.

That’s called discretionary refinement, and it’s something smart traders do all the time.

2. If the trade goes into green, protect yourself

Let’s say the trade instantly moves in your favor and gets close to the TP — within a few percent. You’re now sitting on unrealized profit. Depending on the market conditions, that’s your moment to either:

- Move stop loss to break-even

- Partial out some of the position

- Add a trailing stop if things get volatile

This isn’t about second-guessing the signal. It’s about using it within a professional framework.

3. The re-entry concept: don’t sleep on it

Here’s a scenario that happens more often than you’d expect:

- Trade goes green

- You secure partials or move to BE

- Price reverses and stops you out

- Later, price resets and momentum resumes

- But you’re too scared to re-enter — even though the original signal is still active

This is a missed opportunity. If the trade setup hasn’t been invalidated and momentum returns, re-entering is not just valid — it’s often a higher probability move than the first entry.

4. How They Could've Played It Better Than We Did

There’s always someone in the group who plays the signal better than we do — and we love to see it. That’s the whole point of giving raw signals: you get to trade them your way.

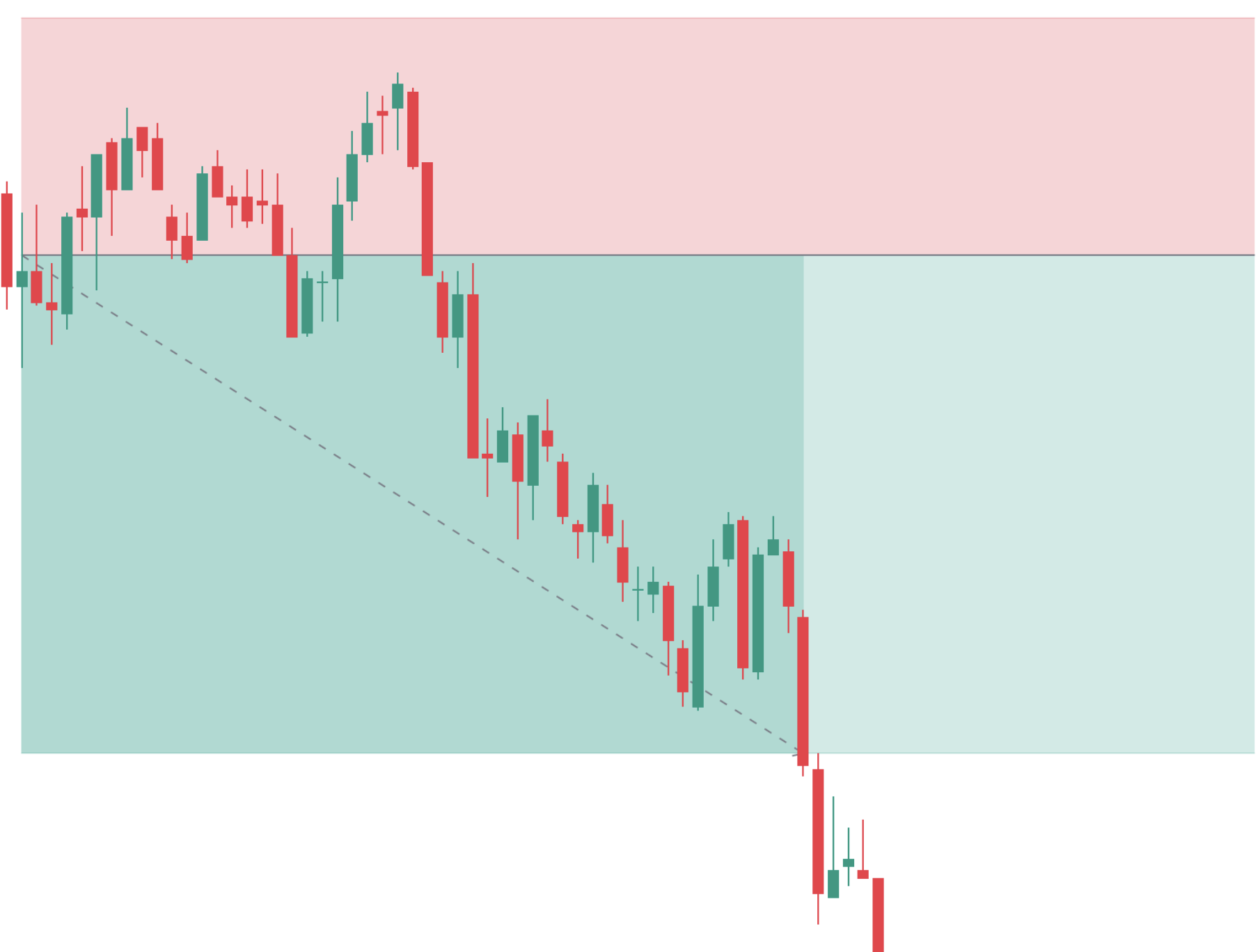

Take a look at this snapshot from the same GLMUSDT short setup:

This is the exact moment price pushed into profit shortly after the entry.

Plenty of our clients played it safe here — moving their stop loss to break-even or locking in a small win with a minimal SL shift. That’s solid risk management.

But then came the retracement.

Price pulled back hard — right toward the original stop zone — without breaking it.

At this stage, some traders got stopped out at BE or with a tiny green.

But others? They saw opportunity.

The signal was still active. Momentum hadn’t died. It was just the market doing what it does — testing nerves, shaking out weak hands, and offering a second chance to those who stay alert.

Here’s how a better-than-system execution looked:

- Wait for price to approach the SL area — but don’t panic

- Re-enter manually or set a limit order closer to the top of the zone

- Use a tighter stop — since you’re closer to invalidation

- Keep the same TP, or even better: stretch it further based on improved R:R

- Result: Higher reward for less risk, and a smoother psychological ride

This is where real traders thrive.

Not because they changed the signal — but because they understood it, and positioned accordingly.

We don’t track or post these custom executions.

But if you want to level up beyond just following alerts — this is where the upside lives.

What We Show vs What You Can Do

We want to be clear about something, especially for new clients.

- We never alter stop loss or take profit after posting

- We don’t “manage” signals once they’re live

- We don’t adjust stats to make us look better

- We let every trade either hit SL or TP

- Our performance is based purely on those binary results

But that doesn’t mean you should trade like a robot.

This is why our displayed win rate is lower than what’s possible with intelligent management.

If we started trailing stops, manually tweaking SLs, or showing multiple re-entries in our records, the stats would look cleaner. But that's marketing theater — not real trading. We'd rather keep it honest, show the raw outcome, and let you use the signal as a trader — not a sheep.

Final Word: One Signal. One Group. One Shot.

There are no VIPs here.

No “Platinum Alerts” with extra filters.

Everyone gets the same setup, at the same time.

We don’t run this like a circus. We run it like a ship — tight, sharp, and aligned.

The edge is in the system.

The edge is in your execution.

And most importantly, the edge is in staying consistent — not perfect.

If you want to use our signals properly, learn to read them like tools, not toys.

Don’t chase the win rate. Chase the process.

Stay focused. Stay sharp. Don’t fuck it up.