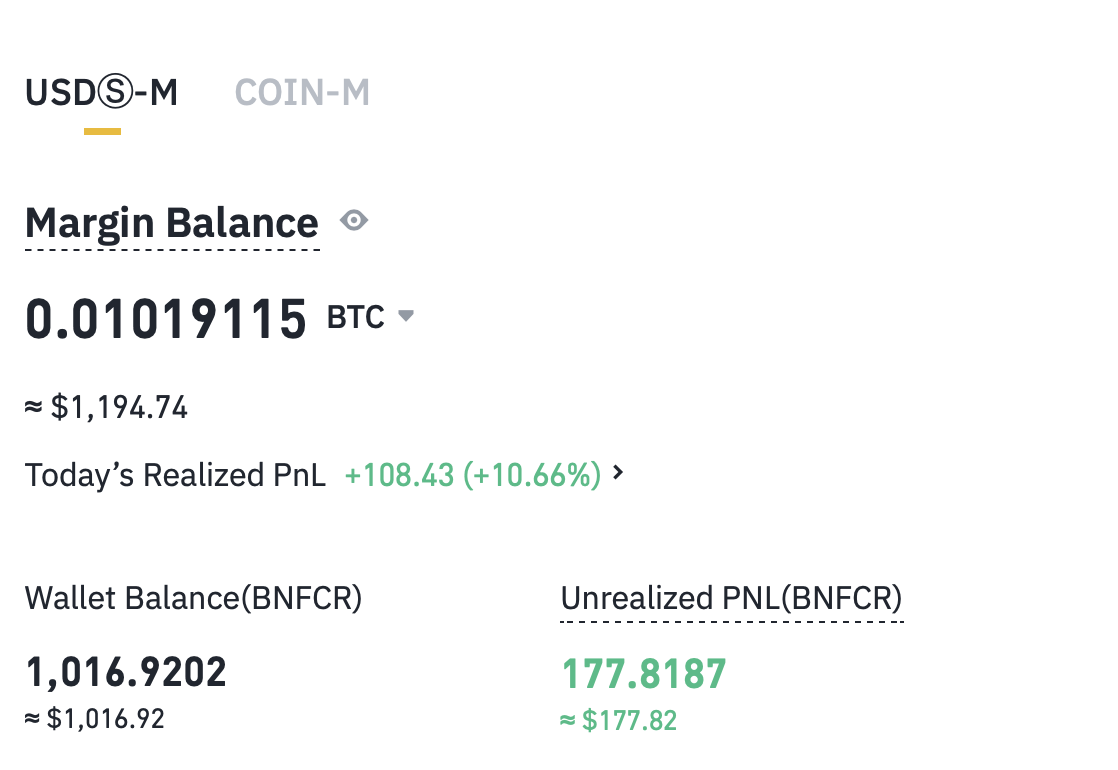

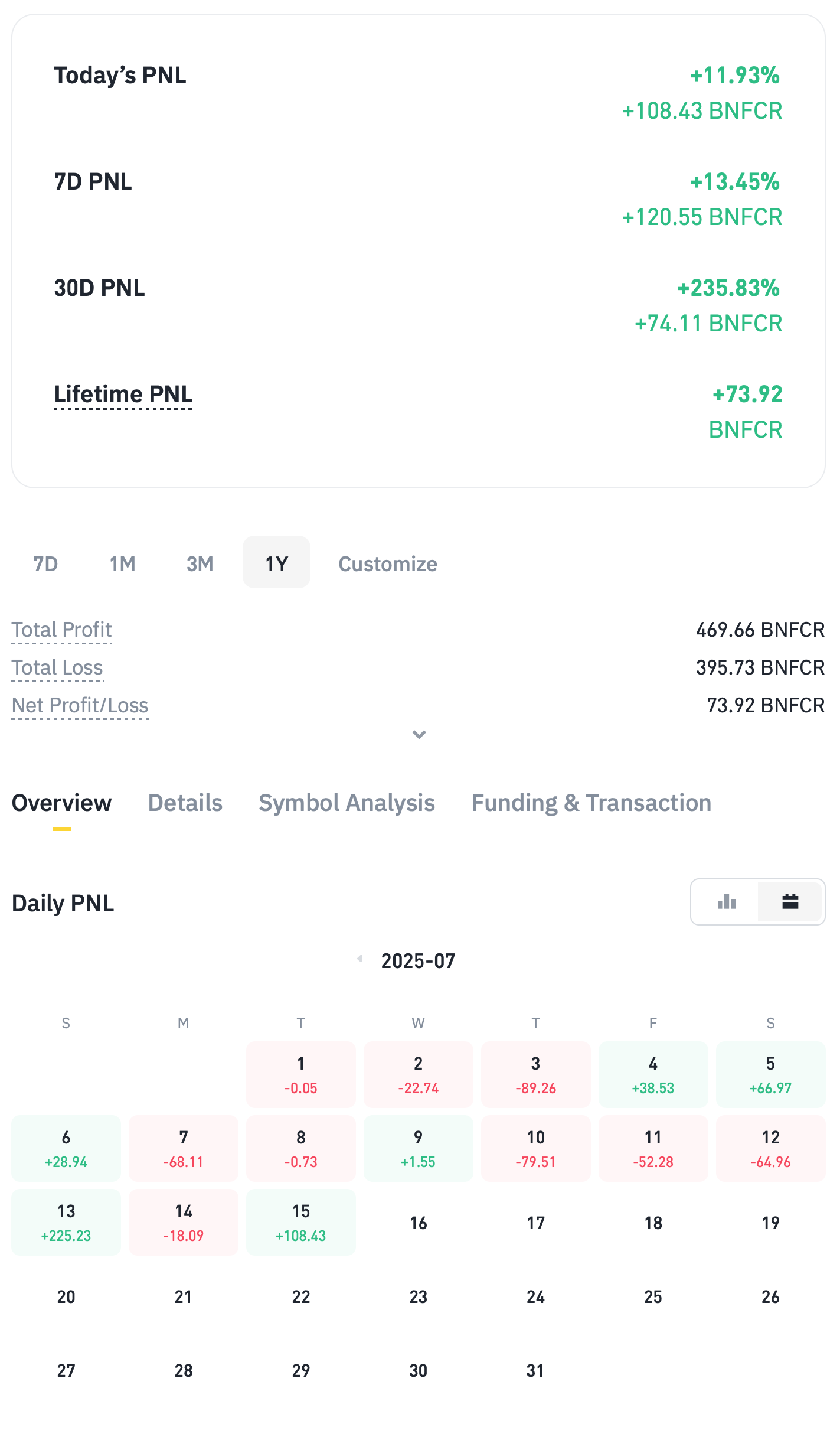

2 Weeks after starting testing of MOMENTUM REVERSAL algo.

Few things to know upfront - at this moment it is OVER-LEVERAGED on purpose, to see how the strategy performs under real market conditions with almost meaningful position sizes.

By the way, we did have quite a nastry drawdown and all those open trades that are in profit when we are posting this... Well they can always do 360, so unless realised - not realised. We stick to honesty, so yeah, this might turn. Also we're quite over-leveraged, like severely over-leveraged! This is not a good practice, but good for our stress-testing of the systems.

Why We're Testing with High Leverage:

1. Position Size Relevance Testing

- Testing with tiny positions (like $50 trades) wouldn't give us meaningful data about how the strategy handles real market impact, slippage, and execution challenges, also data is just too fractional when it comes to all sort of fees, we are not young, we need numbers to be bigger to see them.

- We need to see how the strategy performs when position sizes are large enough to matter in actual trading scenarios, even though 900USD is small - it is better than realistically applicable and logical position for a 940 USD account.

2. Margin Efficiency for Multiple Positions

- Our strategy often holds multiple positions simultaneously for days

- The 20x leverage allows us to maintain 15-20 concurrent positions without tying up excessive capital in margin requirements

- Without leverage, we'd be forced to limit position count, which would distort our strategy testing

3. Risk Management is Still Intact

- Despite high leverage, our risk per trade remains controlled per position

- The strategy can withstand 20+ consecutive losses before account depletion, although even then we will still have something left.

- We're not risking more than we can afford to lose - this is a dedicated testing account. Although it would be sad to lose 1k, but even more sad if we lose the time we spent on development and testing.

- We are willing to allow drawdown to cause most damage at the start of the test of the strategy before going public with it.

4. Real-World Simulation

- Lower leverage testing would create an artificial environment that doesn't reflect how we'll actually trade, although we will never trade positions of the balance size on own accounts. Nevertheless financial value still has an impact psychologically the bigger the stronger, so we have to stick to it.

5. Rapid Data Collection

- Higher position sizes accelerate our learning curve about the strategy's strengths and weaknesses - and as we mentioned before, due to age bigger numbers are easier for us to see.

TLDR:

This approach allows us to stress-test the strategy properly with stupid and unhealthy risk management while maintaining calculated risk parameters.